Encroaching surveillance and regulatory pressure around digital assets

These are all developments from Q4 2023. It seems we're getting closer to the "then they fight us" stage of bitcoin's adoption cycle.

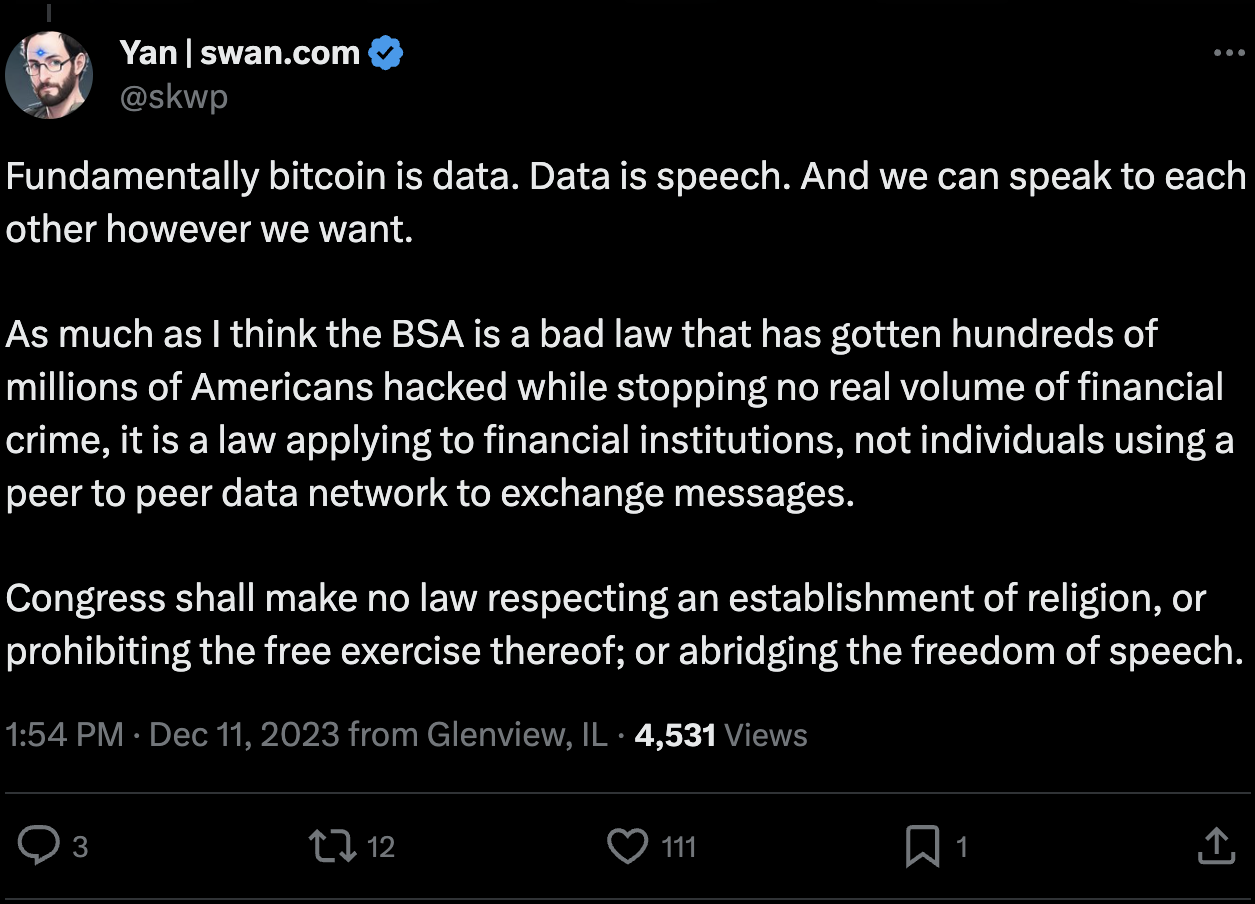

In light of recent comments by legislators and politicians, we must not forget what Bitcoin does and how it does what it does. Bitcoin is text. Bitcoin is speech. Bitcoin is math. Bitcoin has no jurisdiction, just like 2+2=4 has no jurisdiction. Bitcoin knows no borders. Bitcoin is everywhere and nowhere, and if used and secured properly, bitcoin is as confiscatable as a thought. No amount of legalese or otherwise complicated language will change these facts.

Using Bitcoin does not require any special equipment. We use software and specialized hardware to use Bitcoin more efficiently, and in a more secure manner, but in theory, Bitcoin can be run on pen and paper.

The following statements are and will always be true:

- You can create a private key by flipping a coin.

- Holding a private key allows you to receive sats and create transactions.

- Creating a transaction is math.

- Sending a transaction is sending a message.

- Mining bitcoin is guessing a number.

- Everything in Bitcoin is information.

FinCEN Proposal of Special Measure Regarding CVC Mixing

The Financial Crimes Enforcement Network (FinCEN) recently proposed policy FINCEN-2023-0016, named "Proposal of Special Measure Regarding Convertible Virtual Currency Mixing, as a Class of Transactions of Primary Money Laundering Concern". The proposal places extensive reporting requirements on banks and money-service businesses for transactions involving convertible virtual currencies (CVCs) or legal tender digital assets (LTDAs) - basically any cryptocurrency. The policy also prohibits many anonymity-preserving technologies and requires additional customer identity verification for "unhosted" wallet transactions.

On Ego Death Capital's blog, Preston Pysh wrote a fantastic breakdown of this proposal and its implications. Preston's analysis outlined several key areas in which this proposal infringes on constitutional rights and individual liberties:

- Unreasonable searches and seizures - Expansive data collection and identity verification requirements violate 4th amendment protections.

- Freedom of speech and association - Anonymity prohibitions and identification mandates risk chilling effects on protected financial expressions and associations.

- Financial privacy - Reporting rules and AECVC bans erode autonomy over personal finance data and anonymous transactions.

- Due process - Vague standards, excessive penalties, and inadequate procedural protections violate due process rights.

- Personal information security - Onerous data collection and storage rules jeopardize informational privacy rights.

- Non-discrimination - Bias against crypto users, small businesses, and marginalized groups worsens inequality.

- Financial services access - Barriers like reporting, recordkeeping, and identity rules exclude vulnerable communities.

Conclusion

This document provides a critical examination of the Financial Crimes Enforcement Network’s (FinCEN) recent proposal 2023-016, pinpointing potential infringements on individual rights and freedoms. The analysis delves deep into the implications of the proposal on freedom of expression, anonymity, privacy, and association, drawing from a wealth of legal precedents to underscore the gravity of these concerns.

Highlighting the precarious balance between ensuring financial security and upholding constitutional liberties, it is argued that FinCEN’s proposal tips the scales unfavorably. The document emphasizes that, while the demand for transparency is grounded in the aim of ensuring financial security, it inadvertently dampens financial expression and erodes the anonymity and privacy integral to a free society.

Concerns are also raised about the proposal’s potential to exacerbate financial disparities, marginalize vulnerable communities, and erode consumer trust in financial institutions. The document calls for a critical reevaluation of the proposal, urging policymakers to contemplate its far-reaching implications and to seek a balanced approach that protects individual rights while addressing financial crimes.

Most importantly, this document serves as a call to action, encouraging engagement with the policymaking process, voicing of concerns, and advocating for a framework that upholds liberty, ensuring a future where financial integrity and individual freedoms coexist harmoniously.

U.S. Treasury Counter-Terrorist Financing Memo

In a recent memo, the U.S. Treasury Department made recommendations to Congress for new authorities to strengthen counter-terrorist financing laws related to cryptocurrencies. The recommendations raise civil liberties concerns by seeking massive expansion of warrantless surveillance and powers to sanction open source software.

Key areas of concern:

- Vague language suggesting new secondary sanctions could enable sweeping restrictions on crypto transactions that lack transparency and public input.

- Defining non-custodial wallet providers, DeFi services, miners etc. as "financial institutions" subject to existing Bank Secrecy Act rules would inappropriately regulate software providers not in trusted relationships with users - many of the entities Treasury proposes regulating as financial institutions are engaged merely in the publication of software.

- The BSA already gives Treasury extremely broad discretion to monitor any financial transactions and the existing authority can already be used to go much further and potentially criminalize everyday life - expanding that scope is overkill.

- Making blockchain nodes subject to International Emergency Economic Powers Act sanctions is likely technologically infeasible, would threaten free speech, and seeks to resolve issues like the Tornado Cash litigation in an unconstitutional way.

While appropriately filling gaps related to centralized intermediaries could be reasonable, the recommendations overall risk undermining constitutional rights by over-regulating parties not in positions of consumer trust. More precise, transparent policymaking is needed that focuses on accountable institutions rather than sweeping restrictions or surveillance on software and speech.

Digital Asset Anti-Money Laundering Act

Originally proposed in 2022 and met with extreme criticism at the time, the Digital Asset Anti-Money Laundering Act has resurged with wider support this year. Elizabeth Warren has expanded the coalition of Senate support for the bill, which claims to "mitigate the illicit finance risks that crypto poses by closing loopholes and bringing the digital asset ecosystem into greater compliance with the anti-money laundering and countering the financing of terrorism (AMF/CFT) frameworks that govern much of the financial system."

The Digital Asset Anti-Money Laundering Act would:

- Extend Bank Secrecy Act (BSA) responsibilities, including Know-Your-Customer requirements, to digital asset wallet providers, miners, validators, and other network participants that may act to validate, secure, or facilitate digital asset transactions.

- Address a major gap with respect to “unhosted” digital wallets – which allow individuals to bypass AML and sanctions checks – by directing FinCEN to finalize and implement its December 2020 proposed rule, which would require banks and money service businesses (MSBs) to verify customer and counterparty identities, keep records, and file reports in relation to certain digital asset transactions involving unhosted wallets or wallets hosted in non-BSA compliant jurisdictions.

- Direct FinCEN to issue guidance to financial institutions on mitigating the risks of handling, using, or transacting with digital assets that have been anonymized using digital asset mixers and other anonymity-enhancing technologies.

- Strengthen enforcement of BSA compliance by directing the Treasury Department to establish an AML/CFT compliance examination and review process for MSBs and other digital asset entities with BSA obligations and directing the Securities and Exchange Commission and Commodity Futures Trading Commission to establish AML/CFT compliance examination and review processes for the entities they regulate.

- Extend BSA rules regarding reporting of foreign bank accounts to include digital assets by requiring United States persons engaged in a transaction with a value greater than $10,000 in digital assets through one or more offshore accounts to file a Report of Foreign Bank and Financial Accounts (FBAR) with the Internal Revenue Service.

- Mitigate the illicit finance risks of digital asset ATMs by directing FinCEN to ensure that digital asset ATM owners and administrators regularly submit and update the physical addresses of the kiosks they own or operate and verify customer and counterparty identity.

Section 702 of the Foreign Intelligence Surveillance Act (FISA)

The House Intelligence and Judiciary Committees have advanced two competing bills to reauthorize Section 702 of the Foreign Intelligence Surveillance Act (FISA), which allows warrantless surveillance of non-US persons abroad.

On 12/8/2023, the Electronic Frontier Foundation (EFF) wrote an article analyzing the two bills and comparing the implications of each:

- The House Intelligence bill (HR 6611) would renew 702 for 8 years with minimal reforms. It would expand surveillance powers, including using 702 databases to vet immigrants and asylum seekers. The Judiciary bill (HR 6570) is superior - it would ban warrantless searches of the databases concerning Americans, limit data purchases that evade constitutional protections, and only extend 702 for 3 years.

- The analysis argues HR 6611 fails to meaningfully address ongoing abuse of 702 for domestic surveillance, with over 4000 violations annually, especially by the FBI. It represents an unchecked expansion of mass surveillance.

- In contrast, HR 6570 would start to impose oversight, preserve rights against unwarranted searches, and force reexamination of 702 before long-term renewal.

- The article calls for urging Congress members to vote against HR 6611 under the "Queen of the Hill" procedural rule to defeat the Intelligence bill, preventing an entrenchment of overbroad, unaccountable surveillance powers lacking sufficient public debate. The Judiciary bill offers a better path forward by balancing security and liberty interests.

On 12/15/2023, the EFF posted an update article:

- Both proposals (HR 6611 and HR 6570) were pulled from December legislative calendar due to heated debate.

- Section 702 was set to expire December 31, 2023, though language was added to the National Defense Authorization Act (NDAA) to extend the legislative authority of Section 702 through April 2024.

- It is disappointing that, despite all of the reported abuses of the Section 702 program, Congress chose to pass a reauthorization bill instead of making the necessary effort to include critical reforms.

- EFF still urges all Members to oppose the Intelligence Committee’s bill, H.R.6611, the FISA Reform and Reauthorization Act of 2023.

Related News

- Tether Freezes All OFAC-Sanctioned Wallets in 'Proactive' Security Measure

- Wallet of Satoshi to Stop Serving Customers in the United States

- Nodeless.io Shuts Down Due to Investigation for Running 'Illegal Money Transmission' Business in Canada

- Apple Confirms Governments Use Push Notifications to Surveil Users

More Resources

- Warren Expands Coalition of Banking Committee Support for Bill Cracking Down on Crypto’s Use in Money Laundering, Drug Trafficking, Sanctions Evasion

- Elizabeth Warren Introduces Bill to Crack Down on Bitcoin

- Elizabeth Warren Wants to Extend Bank Secrecy Act Regulations to Free & Open Source Software

- The Digital Asset Anti-Money Laundering Act is an opportunistic, unconstitutional assault on cryptocurrency self custody, developers, and node operators

- US House Intelligence Committee’s Section 702 Reform' Bill Marks The Biggest Expansion of Surveillance in United States Since the Patriot Act