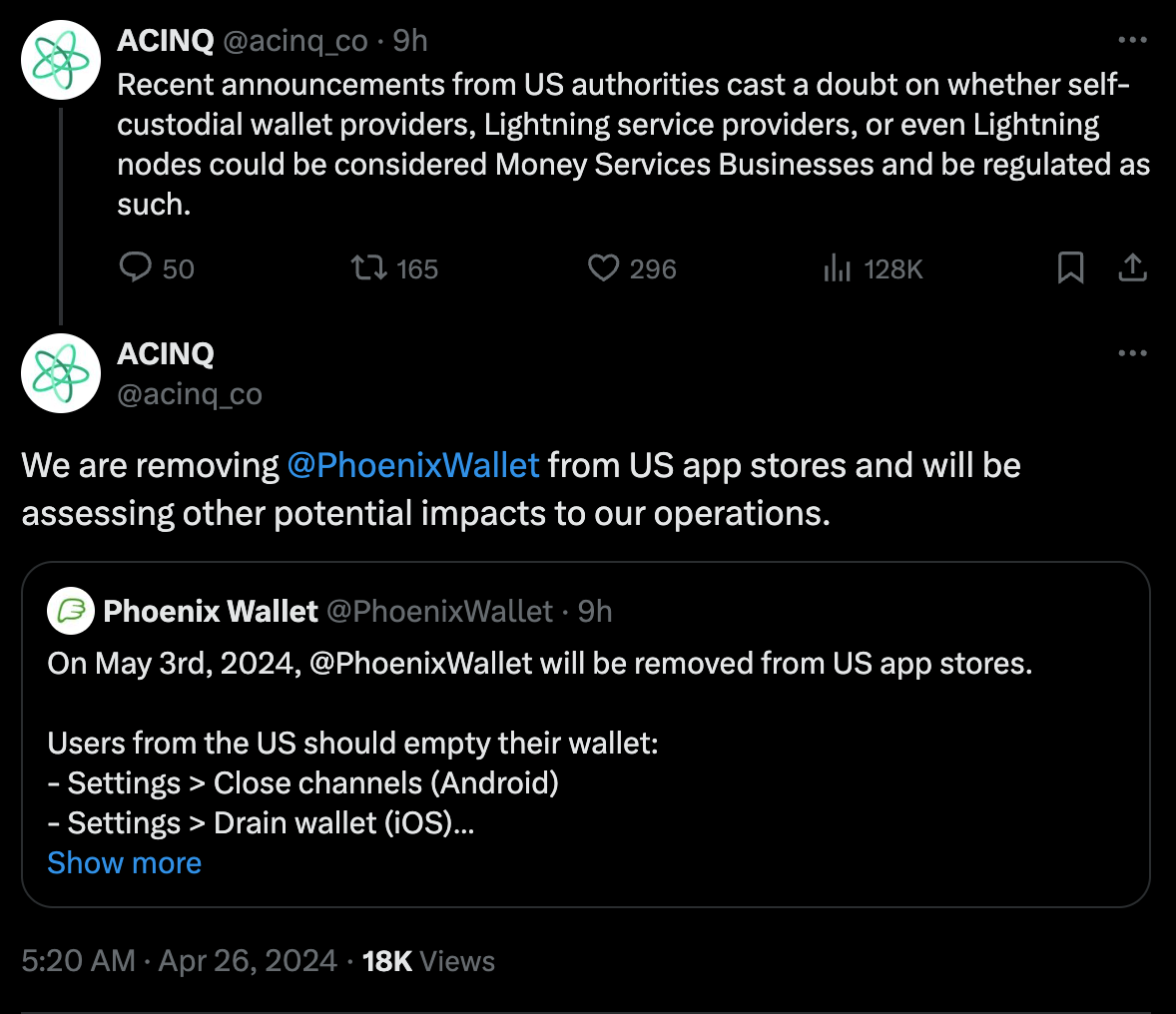

ACINQ launches Phoenixd and announces Phoenix Wallet withdrawal from US app stores

Phoenix stops support for US market

Citing regulatory uncertainty in the US following the arrest and money laundering/unlicensed money transmitting charges against Samourai Wallet operators, ACINQ has announced that they will be removing Phoenix Wallet from US app stores starting May 3, 2024.

If you're looking for another non-custodial LN mobile wallet, consider Mutiny or Zeus, who have both stated their intent to continue operations within the US. If you trust Liquid, then AQUA might be another reasonable alternative.

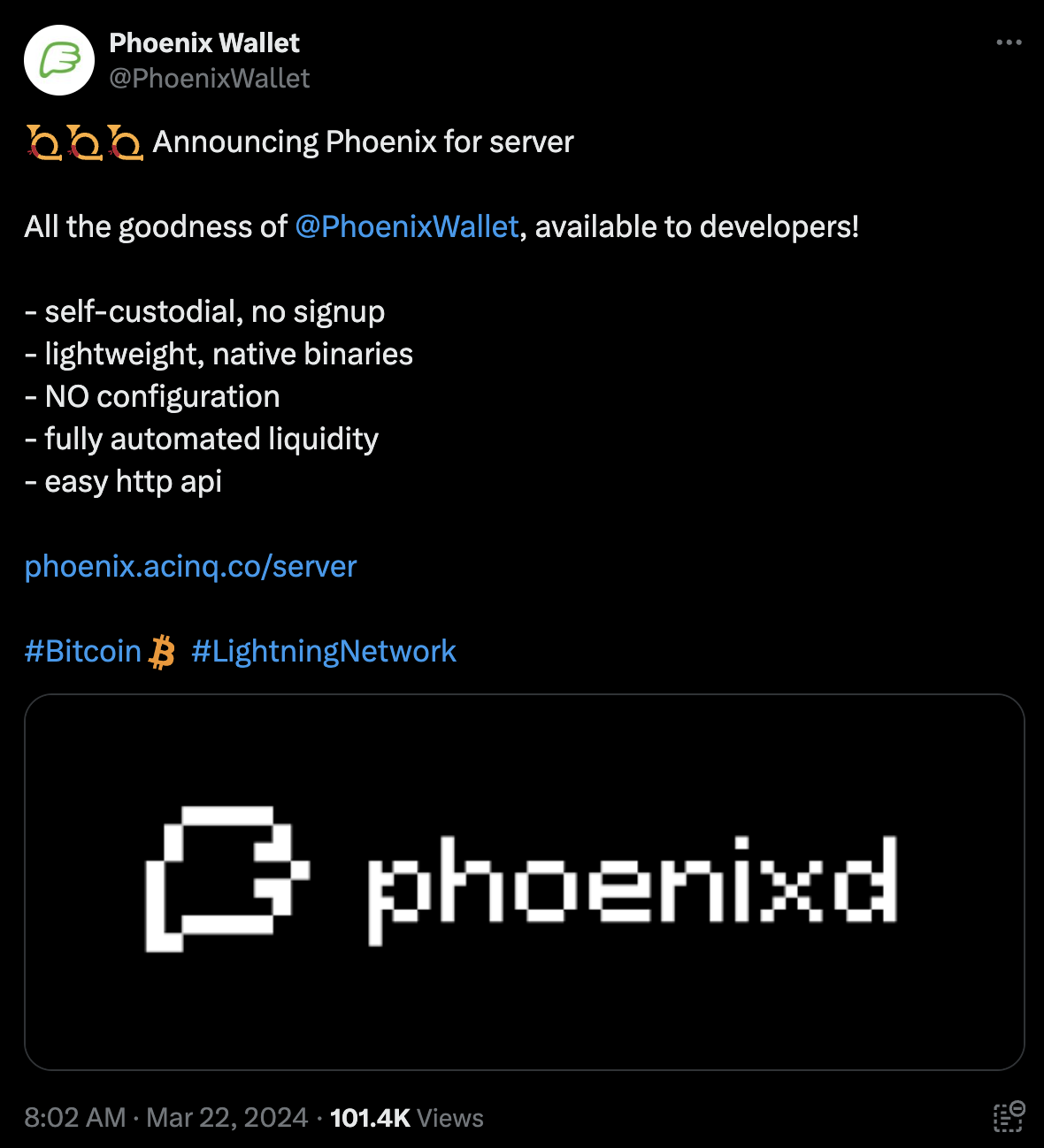

Phoenixd specialized LN node

What is phoenixd?

phoenixd is a minimal, specialized Lightning node designed for sending and receiving Lightning payments.

phoenixd uses the same software as the popular Phoenix Wallet, but:

- runs on a server instead of a mobile device

- offers an http API instead of a GUI

- has fully automated liquidity management to facilitate receive-heavy use cases like merchants, crowdfunding, etc.

phoenixd makes it very easy to develop any application that needs to interact with Lightning, by abstracting away all the complexity, without compromising on self-custody.

Who is it for?

phoenixd is designed for developers/businesses who want to build on Lightning with minimum hassle and maximum reliability, without compromising on self-custody.

You can get ready in seconds, with absolutely zero configuration, no channel management, no peer management, no liquidity management, no firewall configuration.

What is the difference between phoenixd and eclair?

eclair is a highly scalable, general-purpose Lightning node designed for routing and managing a huge number of channels.

phoenixd is a minimal, specialized Lightning node designed for sending and receiving payments.

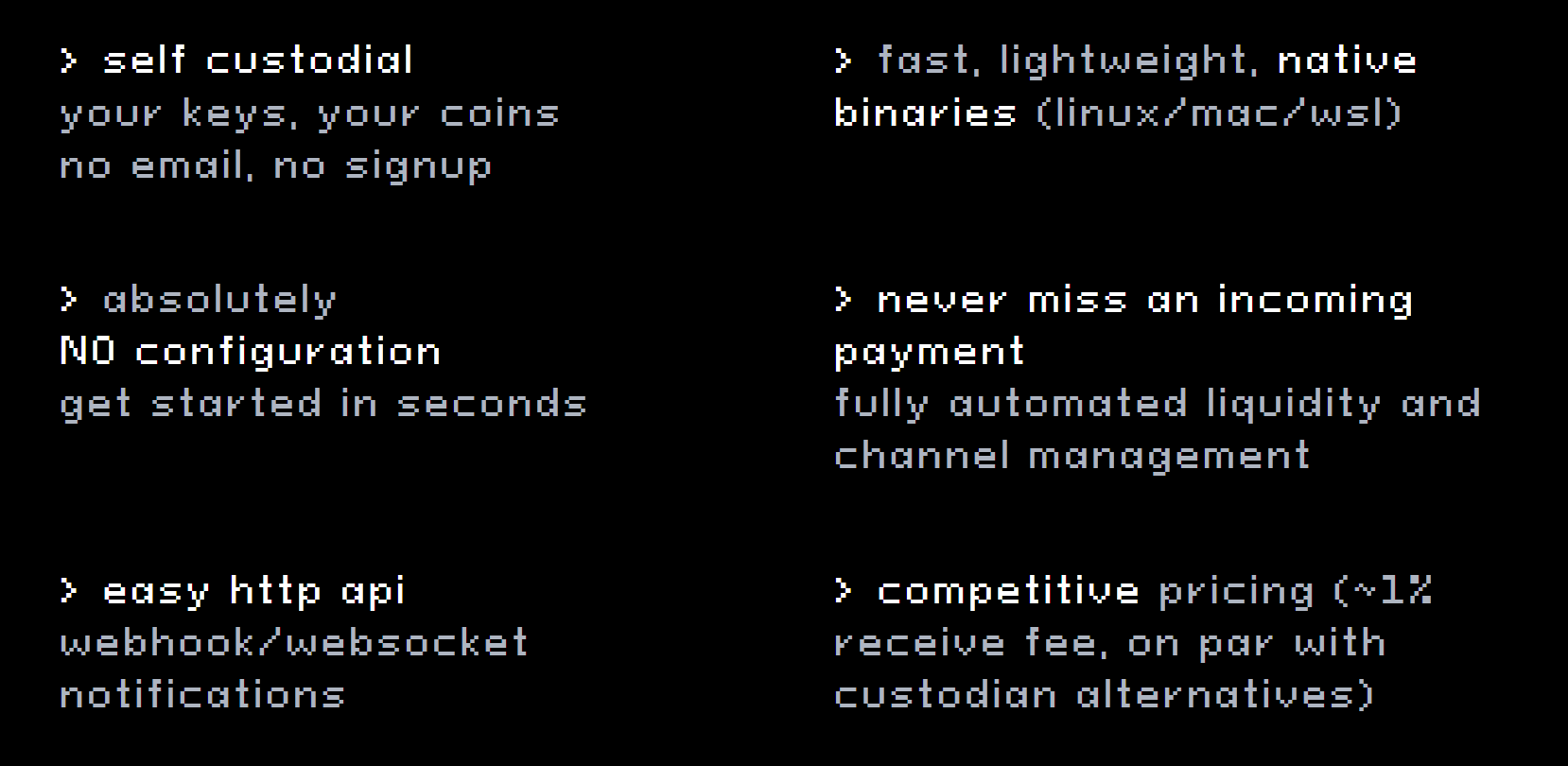

Auto Liquidity

Liquidity management is fully automated.

It is based on the existing on-the-fly channel feature of Phoenix Wallet, with two additional mechanisms:

auto liquidity: every time a channel increase is needed, a large amount of liquidity is requestedfee credit: to facilitate bootstrapping, small payments (too small to pay for a channel creation by themselves) are paid directly to the LSP, instead of being rejected, and will be deducted from future fees. The fee credit is non-refundable.

In other words, when receiving a payment, depending on the situation, the funds either:

- go to your balance (normal scenario)

- are used to purchase inbound liquidity immediately (once in a while)

- are set aside to purchase inbound liquidity later (for small payments at bootstrapping).

From the outside, phoenixd is always accepting payments, resulting in seemingly infinite inbound liquidity, with no threshold effect. You do not have to worry about setting up liquidity, or minimal payment size.

By requesting liquidity in large chunks, the number of on-chain operations is reduced and mining fees are taken out of the equation, in exchange for higher upfront costs.