ACINQ Announces New Version of Phoenix Lightning Wallet That Includes Splicing

ACINQ is the company behind Phoenix and eclair. Eclair is a full Lightning node implementation with a focus on performance and reliability (in contrast to alternatives like Core Lightning and LND). Phoenix is a non-custodial Lightning wallet that is powered by eclair.

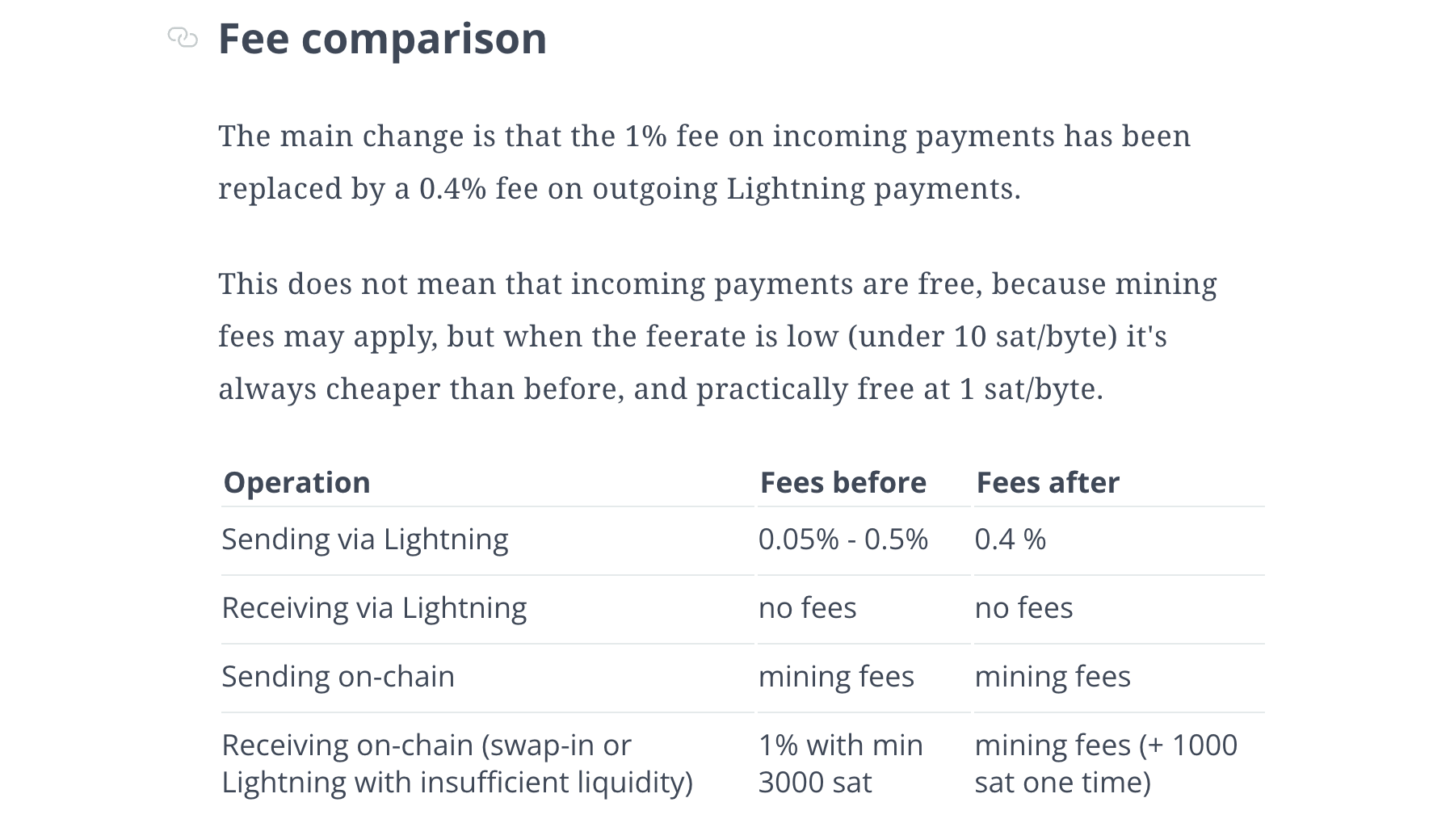

TL; DR: Splicing changes the game. Phoenix now manages a single dynamic channel, no more 1% fee on inbound liquidity, better predictability and control, trustless swaps. The new fee schedule is detailed here.

Only available on Android for now, email phoenix@acinq.co to apply for the beta. ETA for iOS is a few weeks.

Leveraging a technology called splicing, the new Phoenix has the possibility to resize channels, making all those issues go away:

- each user has only one channel

- there is no more scattered liquidity or splitting issues

- adding or removing funds to the channel doesn't add future risk and can be priced at current cost: the 1% / 3000 sat fee is replaced by the mining fee for the underlying on-chain transaction.

Another way to look at it is that we are moving from N UTXOs/user to 1 UTXO/user. It is simply the current optimum for self-custody on Bitcoin. Further reducing the on-chain footprint implies sharing UTXOs amongst users, either in a simplistic trusted way (custodial wallets), or by introducing concepts like virtual UTXOs.

We believe that the efficiency gains brought by splicing are so phenomenal that all wallets will eventually implement it. That is why this technological improvement marks the beginning of a new generation of self-custodial wallets.

Lightning Channel Splicing

Benefits in Phoenix Wallet

- Updated fee structure:

- More predictability and more control

- Phoenix today has to periodically create new channels on the fly, which surprises users with a larger fee (1% with a 3000 sat minimum).

- The new app version seamlessly splices in our out of a single channel as capacity requirements change, and it only requires the user to pay mining fees each time.

- Users can adjust the maximum fee that they are willing to pay for channel management when receiving payments. If the fee is too high, Phoenix will just wait and retry later (for a swap-in) or reject (for a Lightning payment).

- This allows the user to validate the fee before making the payment. It also aligns incentives with the wallet provider, which was previously trusted to find the cheapest route. The wallet provider is now incentivized to find the best (reliable, affordable) route within the fee budget.

- Trustless swaps

- Historically, most Lightning wallets have leveraged swap services to offer a way to seamlessly send and receive on-chain bitcoin transactions (aka "swap-out" and "swap-in").

- Swap-out (paying to a bitcoin address)

- Phoenix's old swap service was very basic, trusted, and didn't let the user choose the feerate for a swap-out.

- In the new version, a splice-out is used to trustlessly send on-chain payments from a Lightning channel.

- Swap-in (sending an on-chain transaction to Phoenix)

- In the previous version of Phoenix, the bitcoin address displayed in the Receive tab wasn't controlled by Phoenix but by the swap service, and for every incoming transaction, a new channel was created.

- With the new Phoenix, funds stay in control of Phoenix during the process. If there is already a channel, the funds will be spliced in and the capacity of the channel will grow by that amount. Otherwise, a new channel will be created using dual-funding.

Phoenix plans to continue expanding on this functionality - the roadmap includes blinded paths, BOLT 12 Offers, and Taproot.